A Quick Guide to Latin American Currencies: What US Companies Need to Know When Hiring Remote Talent

Expanding your workforce by hiring remote talent from Latin America? Understanding the different currencies across the region is crucial for smooth payroll management and avoiding unnecessary costs. Unlike the U.S., where the dollar reigns supreme, Latin America has a mix of local currencies, each with its own exchange rate, stability, and quirks.

To make things easier, we’ve broken down key considerations when making payments to remote employees in the region, how currency fluctuations can impact compensation, and best practices for seamless transactions.

Why Is ‘Peso’ the Most Common Currency Name in Latin America?

If you’ve noticed that several Latin American countries use the term “peso” for their currency—like Mexico, Argentina, Chile, and Colombia—you’re not alone. The name “peso” traces back to the Spanish colonial era when Spain introduced the Spanish dollar, also known as the piece of eight (peso de ocho). This currency was widely circulated throughout the Spanish Empire, including Latin America. After gaining independence, many Latin American nations adopted their own versions of the peso, keeping the name as a historical connection to their colonial past.

The peso became a familiar and trusted term, even as each country developed its own monetary system. While the value of these currencies varies widely, their shared name highlights the deep historical ties among Latin American economies.

What US Companies Need to Consider When Paying Remote Workers

Exchange Rate Volatility – Some Latin American currencies, such as the Argentine peso, are highly volatile. Exchange rates can change daily, impacting the amount your remote workers receive. To avoid unexpected losses, it’s important to monitor rates and consider payment strategies that minimize currency risk.

Preferred Payment Methods – Many remote workers prefer platforms like Payoneer, Wise, Deel, or even cryptocurrency in countries where traditional banking systems are less stable. Some professionals may also request direct wire transfers, but these can come with high fees and longer processing times.

Local Regulations – Some Latin American countries have restrictions on receiving foreign payments. For example, Argentina has strict currency controls that limit the amount of U.S. dollars that can be legally exchanged. Understanding these regulations can help you prevent delays or added fees when compensating your team.

Inflation Impact – Countries like Argentina and Venezuela experience extremely high inflation, meaning salaries may need to be adjusted more frequently to account for the rising cost of living. Companies hiring remote workers in these regions should consider structuring compensation in USD or providing periodic wage reviews to maintain fair pay.

Best Practices for Paying Remote Talent in Latin America

Use Reliable Payment Platforms – Services like Wise, Deel, and Payoneer offer competitive exchange rates and streamlined transactions, reducing the risk of delays or excessive fees.

Consider Paying in USD – Many remote professionals prefer to receive payments in U.S. dollars rather than their local currency to protect against inflation and devaluation.

Monitor Exchange Rates Regularly – If you pay in local currency, staying updated on exchange rates can help you time transactions strategically and minimize currency losses.

Be Aware of Local Banking Infrastructure – Some Latin American countries have slower banking processes, meaning payments may take longer to clear. Discuss preferred payment options with your remote workers to ensure timely compensation.

A Quick Look at Latin American Currencies and Exchange Rates

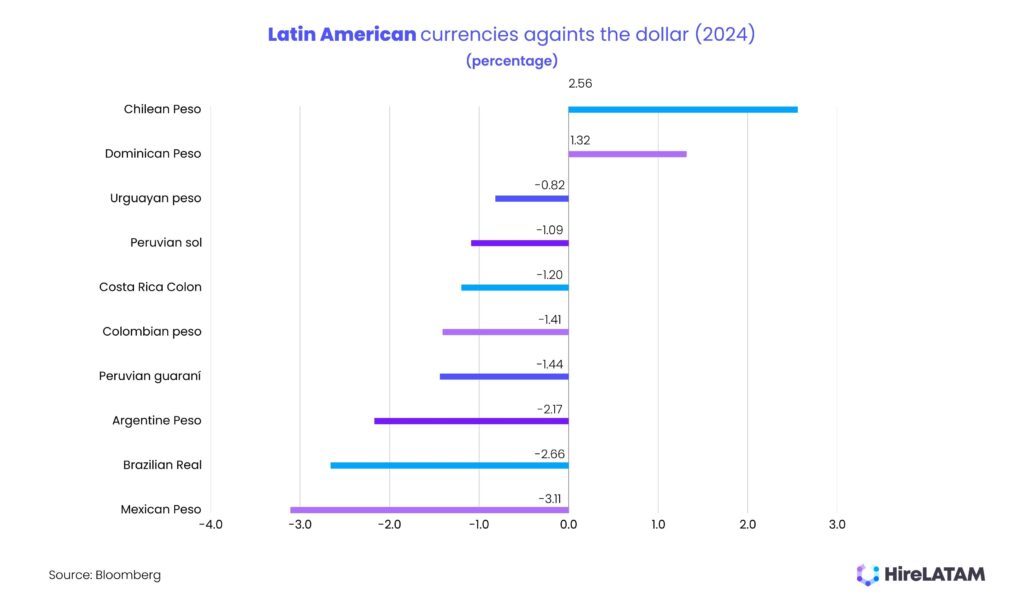

To help you understand how Latin American currencies compare to the U.S. dollar, we’ve compiled a simple chart showing approximate exchange rates as of 2024. Keep in mind that rates fluctuate, so it’s always best to check live conversion rates before making payments.

| Country | Currency | ISO Code | Exchange Rate (1 USD = ?) |

|---|---|---|---|

| Argentina | Argentine Peso | ARS | 1,056.16 ARS |

| Bolivia | Bolivian Boliviano | BOB | 6.93 BOB |

| Brazil | Brazilian Real | BRL | 5.88 BRL |

| Chile | Chilean Peso | CLP | 984.27 CLP |

| Colombia | Colombian Peso | COP | 4,171.48 COP |

| Costa Rica | Costa Rican Colón | CRC | 503.07 CRC |

| Cuba | Cuban Peso | CUP | 24.00 CUP |

| Dominican Republic | Dominican Peso | DOP | 62.01 DOP |

| Ecuador | United States Dollar | USD | 1.00 USD |

| El Salvador | United States Dollar | USD | 1.00 USD |

| Guatemala | Guatemalan Quetzal | GTQ | 7.71 GTQ |

| Honduras | Honduran Lempira | HNL | 25.52 HNL |

| Mexico | Mexican Peso | MXN | 18.00 MXN |

| Nicaragua | Nicaraguan Córdoba | NIO | 36.00 NIO |

| Panama | Panamanian Balboa | PAB | 1.00 PAB |

| Paraguay | Paraguayan Guaraní | PYG | 7,200 PYG |

| Peru | Peruvian Sol | PEN | 3.75 PEN |

| Uruguay | Uruguayan Peso | UYU | 40.00 UYU |

| Venezuela | Venezuelan Bolívar | VES | 45.00 VES |

Hiring remote talent in Latin America offers cost-effective solutions for U.S. companies, but understanding currency differences is key to building strong financial relationships. By staying informed and using the right tools, you can ensure timely, fair compensation for your remote team.

Looking to hire top Latin American talent without the hassle? HireLATAM makes it easy. We connect you with vetted professionals and provide guidance on seamless payments. Get started today!